The Better Way to Pay Your Mortgage

You’ve found your dream home. It has the perfect kitchen for preparing family meals, a beautiful yard for your pets or maybe the workshop you’ve always imagined. What makes your dream home special to you will be as unique as choosing the right mortgage payment schedule.

When you’re getting ready to sign the paperwork for your mortgage, there are a couple of decisions you will have to make. You will need to choose the amortization period, which is the length of time it will take you to pay off your mortgage. The most common amortization period is 25 years. You will also need to choose your payment schedule.

Choosing a payment schedule

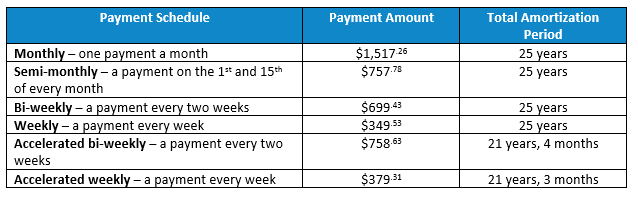

Based on a $250,000 mortgage1, with a 25-year amortization period, here are examples of your potential mortgage payments.

When you’re getting ready to sign the paperwork for your mortgage, there are a couple of decisions you will have to make. You will need to choose the amortization period, which is the length of time it will take you to pay off your mortgage. The most common amortization period is 25 years. You will also need to choose your payment schedule.

Choosing a payment schedule

Based on a $250,000 mortgage1, with a 25-year amortization period, here are examples of your potential mortgage payments.

To see payments based on a different amount, use our Mortgage Calculator.

Choosing between accelerated and non-accelerated

If you determine that weekly or bi-weekly payments best fit your budget, you also have the option to go with an accelerated payment schedule.

The difference between accelerated and non-accelerated payments are the way that the payments are calculated. For example, with both the bi-weekly and accelerated bi-weekly mortgage, you will make 26 payments a year, but the accelerated payment will be higher.

Over the course of the year, the higher payment results in approximately an extra month worth of payments applied directly to the principal of your mortgage, saving you money in interest and shaving time off your amortization period, as seen in the table above. Sticking with a non-accelerated option, you may find your budget has more breathing room, resulting in more cash flow each month.

Flexible payment options

Once you’re settled into your new home and used to your newly revised household budget, you may find that you’re interested in changing your payment schedule. Reach back out to your Financial Advisor and see if there is a better payment schedule to help meet your goals.

If you have extra available funds, you may consider increasing your regular mortgage payment or making a lump sum payment of up to 20%. If you don’t have 20% of your mortgage sitting in the bank, you can still make additional smaller payments, as little as $100 per calendar year. We have also found that using your tax refund or setting aside $50 a month to make a $1,200 lump sum payment are great ways to help pay down your mortgage faster. Anytime you add extra money to your mortgage, even if it’s a small amount, you can have a big impact on the amount of interest you’ll pay and the time it will take you to pay off your loan. For example, if you paid an additional $1,200 each year on a $250,0002 mortgage, you could shave 3 years off your amortization term.

For some people, choosing an accelerated schedule or putting extra money on their mortgage is a great option, but they won’t be the best options for everybody. If you have other loans or credit card debt, it may be best to tackle those first, free up your cash flow and save the money you would pay in other interest. Another important priority is having a healthy emergency fund. To work with a Financial Advisor, call 902.492.6500. We’re here to help you achieve your goals.

Revised Jan. 12, 2022

1 These numbers are based on a 5.44% mortgage rate, on a five-year fixed term.

2 This number is based on $250,000 mortgage with a 25-year amortization period, a 5.44% mortgage rate, on a five-year fixed term with bi-weekly payments.

Choosing between accelerated and non-accelerated

If you determine that weekly or bi-weekly payments best fit your budget, you also have the option to go with an accelerated payment schedule.

The difference between accelerated and non-accelerated payments are the way that the payments are calculated. For example, with both the bi-weekly and accelerated bi-weekly mortgage, you will make 26 payments a year, but the accelerated payment will be higher.

Over the course of the year, the higher payment results in approximately an extra month worth of payments applied directly to the principal of your mortgage, saving you money in interest and shaving time off your amortization period, as seen in the table above. Sticking with a non-accelerated option, you may find your budget has more breathing room, resulting in more cash flow each month.

Flexible payment options

Once you’re settled into your new home and used to your newly revised household budget, you may find that you’re interested in changing your payment schedule. Reach back out to your Financial Advisor and see if there is a better payment schedule to help meet your goals.

If you have extra available funds, you may consider increasing your regular mortgage payment or making a lump sum payment of up to 20%. If you don’t have 20% of your mortgage sitting in the bank, you can still make additional smaller payments, as little as $100 per calendar year. We have also found that using your tax refund or setting aside $50 a month to make a $1,200 lump sum payment are great ways to help pay down your mortgage faster. Anytime you add extra money to your mortgage, even if it’s a small amount, you can have a big impact on the amount of interest you’ll pay and the time it will take you to pay off your loan. For example, if you paid an additional $1,200 each year on a $250,0002 mortgage, you could shave 3 years off your amortization term.

For some people, choosing an accelerated schedule or putting extra money on their mortgage is a great option, but they won’t be the best options for everybody. If you have other loans or credit card debt, it may be best to tackle those first, free up your cash flow and save the money you would pay in other interest. Another important priority is having a healthy emergency fund. To work with a Financial Advisor, call 902.492.6500. We’re here to help you achieve your goals.

Revised Jan. 12, 2022

1 These numbers are based on a 5.44% mortgage rate, on a five-year fixed term.

2 This number is based on $250,000 mortgage with a 25-year amortization period, a 5.44% mortgage rate, on a five-year fixed term with bi-weekly payments.